Commodities Update – 01/10/2015

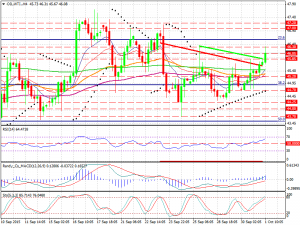

October 1, 2015WTI Oil: US oil continues to trade higher, as the recent global updates offset the worries over rising crude supplies. Markets continue to cheer the latest China manufacturing PMI reports which reflected that the economy’s manufacturing sector showed slight improvement in September with both the gauges coming in above estimates. China is the world’s second largest consumer of oil. Moreover, Russian and US air strikes in Syria could also lend further support to oil prices. Later in the day, oil traders will watch for the US dollar moves as the US manufacturing report and weekly jobless claims may spur some volatility in the market.

WTI oil has an immediate resistance which stands at 46.74 levels above which gains could be extended to 47.15 levels. Meanwhile, support is seen 43.92 levels from here losses could be extended to 43.

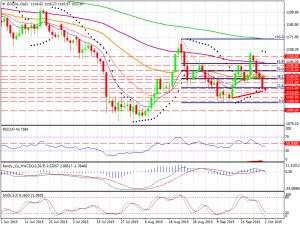

Gold: Gold extends the rout for the fifth straight session on Thursday as the stabilizing global equities and upbeat US fundamentals continue to dull the safe-haven appeal of the bullion. The yellow metal remains under tremendous pressure as possibilities of the Fed rate-hike this year keep growing amid strengthening US labour market. The US ADP non-farm employment change report released on Wednesday showed the employers in the private sector added 200,000 jobs in September, coming in above the market forecasts for a 190,000 increase.

Moreover, strong performance on the global equities in the last two days further diminished the bids for the safe-haven while boosting the US dollar. Looking ahead, focus now shifts towards the much awaited US payrolls data due on Friday for further moves on the gold. While a batch of US data due later today will be also closely monitored.

The metal has an immediate resistance at 1115.70 (Today’s High) and 1119.90 (Sept 16 High) levels. Meanwhile, support stands at 1110 levels below which doors could open for 1104 levels.