Daily Market Update – 27/04/15

April 27, 2015Monday 27th April 2015 – 09:00

We enter the new week with the US Dollar on its back foot and currencies continuing to show signs of rebound. It seems some overall softer data out of the US these past couple of weeks has led many investors to believe the Fed will come out a little more on the dovish side at this week’s meeting. The FOMC aside, the other main points to watch this week will be on Central Bank policy decisions by the BOJ (Wed) and RBNZ (Thur) as well as Provisional Q1 GDP data from the US (Wed) and CPI and Jobs data from the EU and Germany (both Thur). This morning looks set for a quiet start with no data of note this morning. Good luck.

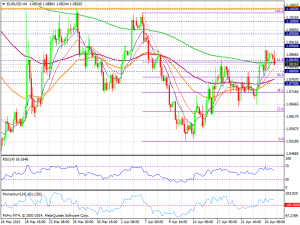

EUR/USD: The EUR/USD pair rose during the session on Friday, breaking above the 1.08 level. However, we see a significant amount resistance all the way to the 1.10 handle, so we are not too enthused about going long at this point. We believe that a resistant candle towards that area will be an excellent selling opportunity as it should just simply continue the consolidation that we have seen over the last several weeks. Ultimately, we believe that the Euro will continue to have issuesoverall, and therefore we do not like buying anyway.

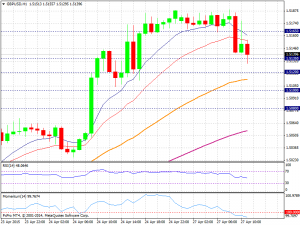

GBP/USD: Cable broke out to the upside during the course of the session on Friday, breaking the top of the hammer that had formed on Thursday. We also clear the top of the spike that had formed back in March and that looks very bullish at this point in time. If we can get above the top of the range for the session here on Friday, the market should then head to the 1.52 level. In this area, we would anticipate seeing quite a bit of resistance. Pullbacks should be buying opportunities and with that, we don’t have any interest in selling this market until we get below the 1.50 level.

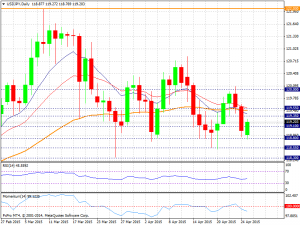

USD/YEN: The USD/YEN fell hard during the course of the session on Friday, as the pair continues to bang around and consolidate. Just below at the 118.50 level we see quite a bit of support, so we think that that is going to be a bit of a “floor” in this marketplace. With that, we are simply waiting for a supportive candle in order to start buying yet again. We have no interest in selling, the US dollar has been so strong recently and it’s a bit difficult to imagine selling it even though the Japanese yen is a safety currency.

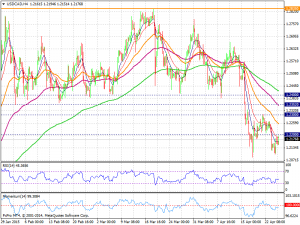

USD/CAD: The USD/CAD pair initially fell during the course of the session on Friday, but found enough support below to turn things back around and form a hammer. Because of this, we feel that this pair will go a little bit higher during the session today, but we recognize that the 1.23 level above will be resistive. Ultimately, we believe that this is a market that’s going to continue to make very small moves, so short-term trading is about the only thing that we can do. We have no interest in hanging onto any trade for any real length of time at this moment as the oil markets seem to be at very important levels.

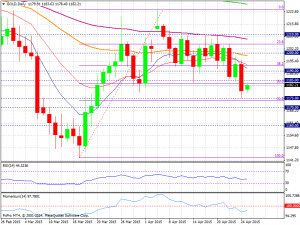

Gold: Gold finally broke down and headed below the 1183 support of recent sessions to make a low of 1175 (1174: 61.8% of 1142/1224). The 4 hour charts are pointing lower, opening the chanceof heading towards 1164 (minor) and 1162 (76.4%). Below this would see another run back to 1150 and the previous trend low at 1142, although the daily indicators are still rather flat, so this may take a while and I suspect conditions will remain choppy, albeit at a slightly lower level than we have recently been used to. Back above 1280/85 would see Gold return to the 1200 area although possibly not in the next few sessions. However if the dollar does see a deeper selloff, then commodities will realign themselves and head higher. Above 1200/05 resistance the points to watch remain intact and would allow a stronger test of the 100 DMA (1211). A break of this would allow a run to the 200 DMA at 1230 but right now seems unlikely.