FX Update

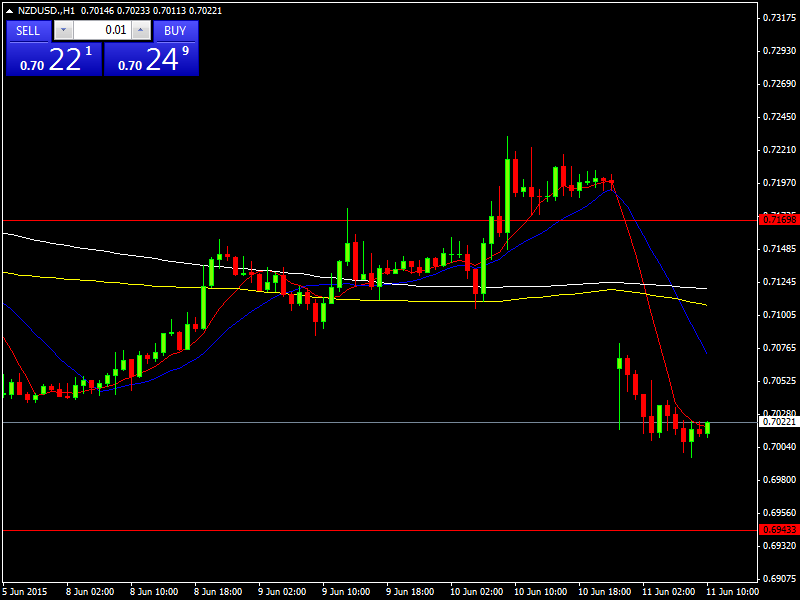

June 11, 2015The Reserve Bank of Australia slashed rates and came out in a dovish tone about the current state of the economy, especially on the weak demand for milk. The economy is also faced with problem of low inflation as well as a possible fall in income. On the back of this comment, the market reacted in a very aggressive way, NZDUSD dropped all the way from 0.71923 to 0.7000. There is a high possibility of further downward move most especially if data coming from US gets stronger. The RBNZ justified the rate cut based on the deterioration of the current account balances.

In the US, the retail sales figure comes out later today. This is a strong macroeconomic indication of strength of the US economy. The US core retail is expected at 0.7%, while retail sales are expected at 1.1%. If the data comes out stronger than expected, we might see some rally in the US crosses, possible taking us back to the NFP level.

The chart below shows the levels before the Reserve Bank of New Zealand statement and after.

Chart 1: NZDUSD