Indices Update – 29th January 2015

January 29, 2015Thursday 29th January 2015 – 12:50

The announcement of statement from the Federal Reserve suggests that the US remains the last man standing in terms of its path towards rate tightening. Investors drew differing conclusions from last night’s decision and subsequent statement and it is most certainly true that the Fed did sound more upbeat about the state of the US economy, noting the strong job gains and improving labour market. The words “considerable time” were removed and have been effectively replaced with “patient”. The Fed also noted a “strong” labor market and “solid” growth, whilst the voting was unanimous. The reaction in markets was swift, with a selloff developing that saw gains from earlier in the day swiftly disappear. With the positive sentiment from the ECB fading and Greece still in the headlines it looks like a more cautious atmosphere will prevail for the time being. Indices have retreated this morning, after the meeting was widely viewed as disappointing in terms of equity market risk appetite.

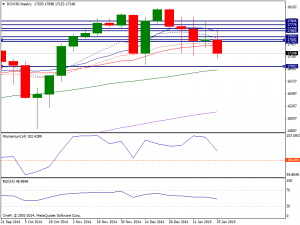

Dow: The Dow as you can see initially tried to push higher during the course of the session on Wednesday, but found the 17500 level but found it to be a bit too resistive. With that being the case, the market looks as if it continues to see a bit of downward pressure, but the 17000 level below is massively supportive and therefore we think that eventually this market does continue to bounce every time it pulls back. Ultimately, the market should continue to go higher overall and as a result we are bullish.

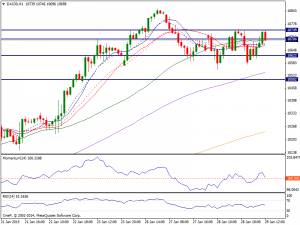

Dax: Aside from the fact that the DAX has opened lower today, the signs of a stalling in the bull run are mounting. There has been a basic RSI sell signal (cross back below 70), whilst the MACD histogram is also falling away. The Stochastics have rolled over and over the past few months this has in the least offered up a period of consolidation (if not correction). Looking on the hourly chart will be interesting as during the bull run the RSI has consistently sat above 40 with the MACD lines in positive configuration. If this configuration starts to break down then it would suggest the run could be at an end (at least in the short term) and there is a correction that could start to drag the DAX lower.

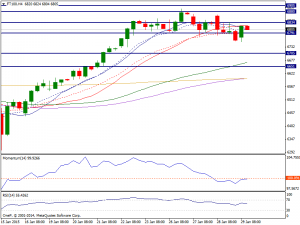

FTSE: The FTSE has seen three days of losses but it still has yet to break through the lows seen on Monday. It went back and forth during the course of the session on Wednesday, as we continue to hover around the 6800 level. That being the case, it appears that the market is going to grind a little bit to the side as we trying to break out above 6900, an area of significant resistance. As soon as we get that move, we feel that this market will head straight to the 7000 handle and beyond. We are buyers of dips and have no interest in selling the FTSE as we have seen so much bullish pressure lately and believe that this is simply the market taking a breather.