Indices Update – 2nd February 2015

February 2, 2015Monday 2nd February 2015 – 10.15

Many asset classes ended the first month of 2015 on the back foot and February starts with a feeling of apprehension. The dollar strength seems to have halted and risk in equities is being called into question especially since January saw the S&P 500 close in negative territory, historically considered to be a bad sign for equities leading to a negative year for the stock market. On the other side, European markets had one of their best months in three years last month, despite concerns about the prospect of Greece default as the new Greek government continues to confront EU leaders about the direction of its current bailout program, with both sides setting out their respective positions. There is little doubt that the main reason behind last month’s strong gains is the prospect of the ECB’s €60bn of extra stimulus per month and it is this that is acting as a stabilising buffer, which is helping anaesthetise markets against the uncertainty in Greece.

Over the weekend, the heads of the new Greek government have been meeting with counterparts within the Eurozone in an attempt to garner support to renegotiate its bailout terms. New Greek finance minister Varoufakis is already setting out on a charm offensive with a tour of European capitals, visiting London today to drum up support for Greece’s position and exert pressure on Germany to be more accommodative with respect to a change of policy direction. Germany remains, for its part firmly opposed to any form of debt reduction, as do the Finns and it is these two stances that are becoming increasingly difficult to reconcile given that Greece’s debt is to all intents and purposes unsustainable. The French have been reasonable in their reaction, quite whether Mrs Merkel reacts in the same way is yet to be seen. However, this is an issue which will continue to rumble on in the background for markets and is yet to cause any significant impact outside of Greece.

The new week has begun with market sentiment starting slightly on the back foot today. The HSBC Chinese manufacturing PMI came in a touch below expectation at 49.7 (49.8 had been forecast) which coming on the back of a slight miss in the official government PMI for China over the weekend and a slightly disappointing first read of US Q4 GDP, markets are in a slightly negative mind-set today. This is likely to put pressure on the People’s Bank of China for further easing. In a surprise move in November, the Bank cut its official interest rate for the first time in more than two years to support growth. This time, we could see a combination of a rate cut and reserve requirement ratio (RRR) cut to put more liquidity into the economy. Such a move is likely to be positive for the commodity currencies of AUD and NZD.

Today sees a raft of manufacturing data from across both sides of the pond with PMI data from the Eurozone and UK, where both are expected to tick higher and then the US enters the fray this afternoon where the ISM Manufacturing figure is due to tick lower. This ahead of a busy week which culminates in the non-farm payroll and note again the RBA meets overnight.

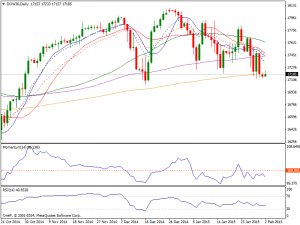

Dow: US indexes plunged on Friday with the dow losing 252 points to close at 17164.95. It has not been a good start for the year as the index closed this first month down 3.7%. Friday’s slide came after US GDP figures, showing that economic growth cooled down in the last quarter of 2014. Nevertheless, consumer confidence measures in the US all through last week surged strongly, whilst the FED remained confident in how the labor sector is doing, limiting the negative effect of a weak GDP. The DJIA however, risks a strong downward continuation as per approaching last December low set at 17039. Technically the daily chart shows the index pressuring its 200 SMA, dynamic support that contained the downside for 3 days in a row, while indicators aim lower below their midlines. That being the case, the market looks like it could break out to the upside if we break the top of the range for Friday. At that point in time, we would anticipate this market heading to the 17800 level. Ultimately, we think that pullbacks will continue to be buying opportunities and as a result we are bullish of this market currently.

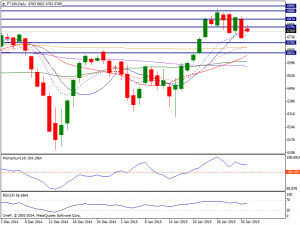

FTSE: The FTSE closed last Friday down at 6749.40 but recorded in January its best monthly performance in almost a year, having gained 2.8%. That being the case it looks as if we are trying to find support in order to go higher and break above the 6900 level, which of course has been so resistive previously and if we can get above there we should continue the uptrend which is exactly what we expect. Ultimately, we think that pullbacks are buying opportunities as the FTSE should continue to strengthen.

Dax: The Dax pushed higher at the open on Friday, but turned back around to continue the consolidating action that we’ve seen recently. Nonetheless, the weekly candle is a shooting star, so we believe that the market will more than likely pullback. Daily basis, the index seems to be consolidating inside a small wedge, while developing near its all time highs. In the same time frame, indicators had lost upward potential and head sharply lower from oversold levels. That being the case, we feel that looking for pullbacks to find supportive candles lower will be the way to go going forward as the market should continue to show quite a bit of strength. With the softening euro, the stock markets in the European Union should continue to strengthen overall and the DAX of course will lead the way. Downward risk may only increase with a break below 10552 of the lows of last week.