Market outlook

November 5, 2015USD strength continues to weigh down on all currencies and commodities across the market, this was rejuvenated last night when the Federal reserve chairman Janet Yellen reiterated that interest rate hike for December is not off the table and does not see the need for negative rates for now and she also said US economy is performing well: slack diminishing, inflation will rise as pressures on the economy ease. USD bulls got really excited about this piece of information and market saw a massive rally across the board. Gold bears continue to weary as the precious metal prices further dipped to the downside clearing the $1117 support and now trading below $1110. USDJPY also feeling the effect of strong dollar and Abenomics as the currency is on 2 weeks rally now trading comfortable above $120.00 which is the major support level that could see prices rally to $125.00 in the next couple of trading days.

Euro continues to sell off across the board on the back of strong USD and also expansion of the ongoing quantitative easing in the Eurozone in December. Eurusd now comfortably trading below the 1.10 level and yesterday, the bears put more pressure the push prices below 1.090.if USD strength continues to was stronger Eurusd might reach parity by the end of the year.

Sterling’s fate will be decided today as the market anticipates the ‘super Thursday’. The bank of England will be releasing an inflation report today coupled with interest rate decision and MPC meeting minutes. This will give a clear direction to the outlook of GBP over the next coming trading days.

US will be releasing some economic data later today: initial jobless claim, labour cost and non-farm productivity. All these will further give us more insight into FED’s decision in December. Ivey PMI data will also be coming from Canada later today; market is expecting an increase from 53.7 to 54.0.

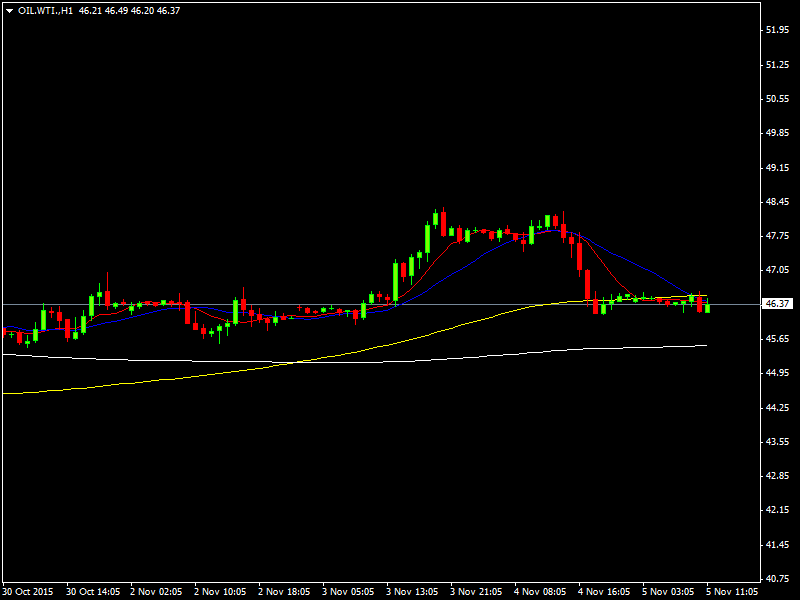

Oil inventory released yesterday also indicates that we have more oil in the stock as inventory rose to more than 2.8M barrels. WTI price dropped on the back of this from $48.34 to $46.34.

Fig 1: WTI 1HR chart