NFP Outlook

June 5, 2015The market awaits the monthly Nonfarm payroll from the US economy later today at 13:30UK time. This gives an insight into the performance of the labour market in the US economy. This is one of the most important indicators of economic growth in US. This is the major indictor of a potential rate decision.

The market expects a figure stronger than the previous month which was 223,000 and now expects 225,000 for the month of May. Most analysts assume the data might probably beat expectation. If the data comes out really strong, we might see a massive USD buy across board and vice versa.

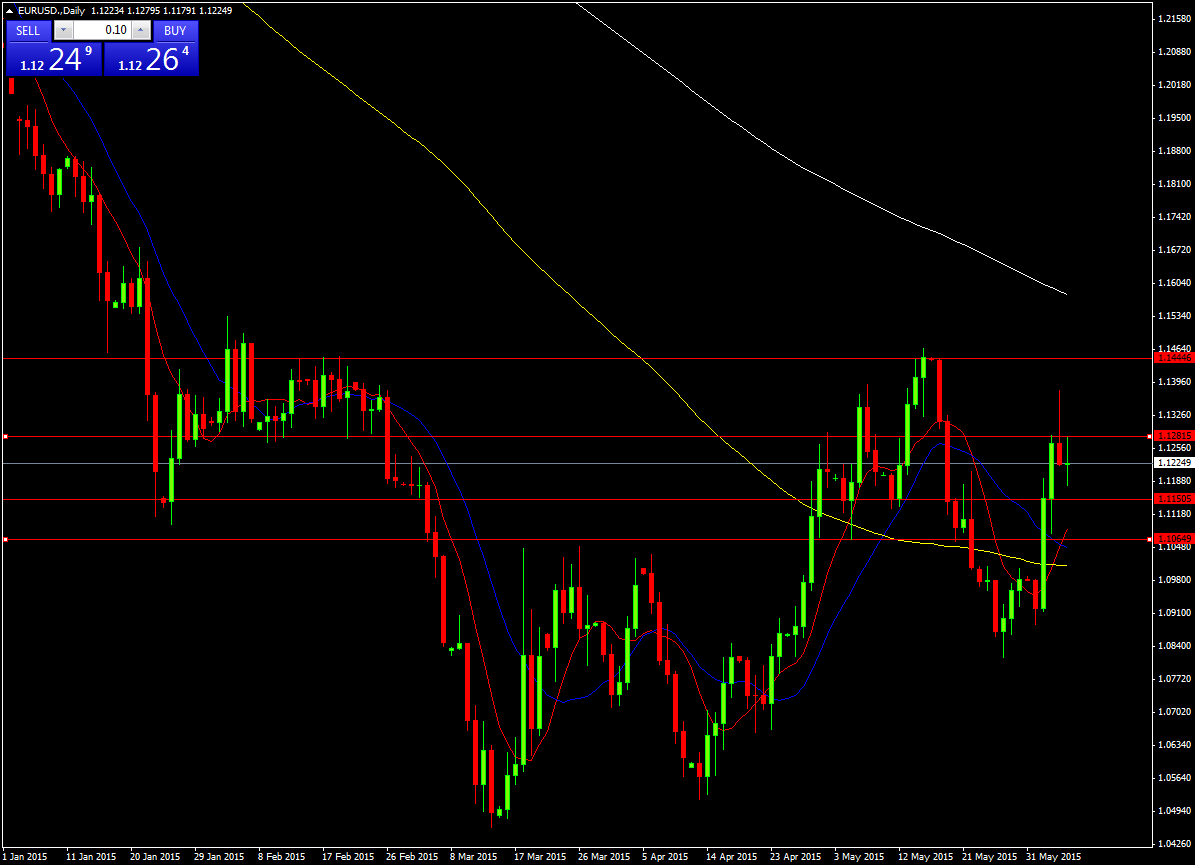

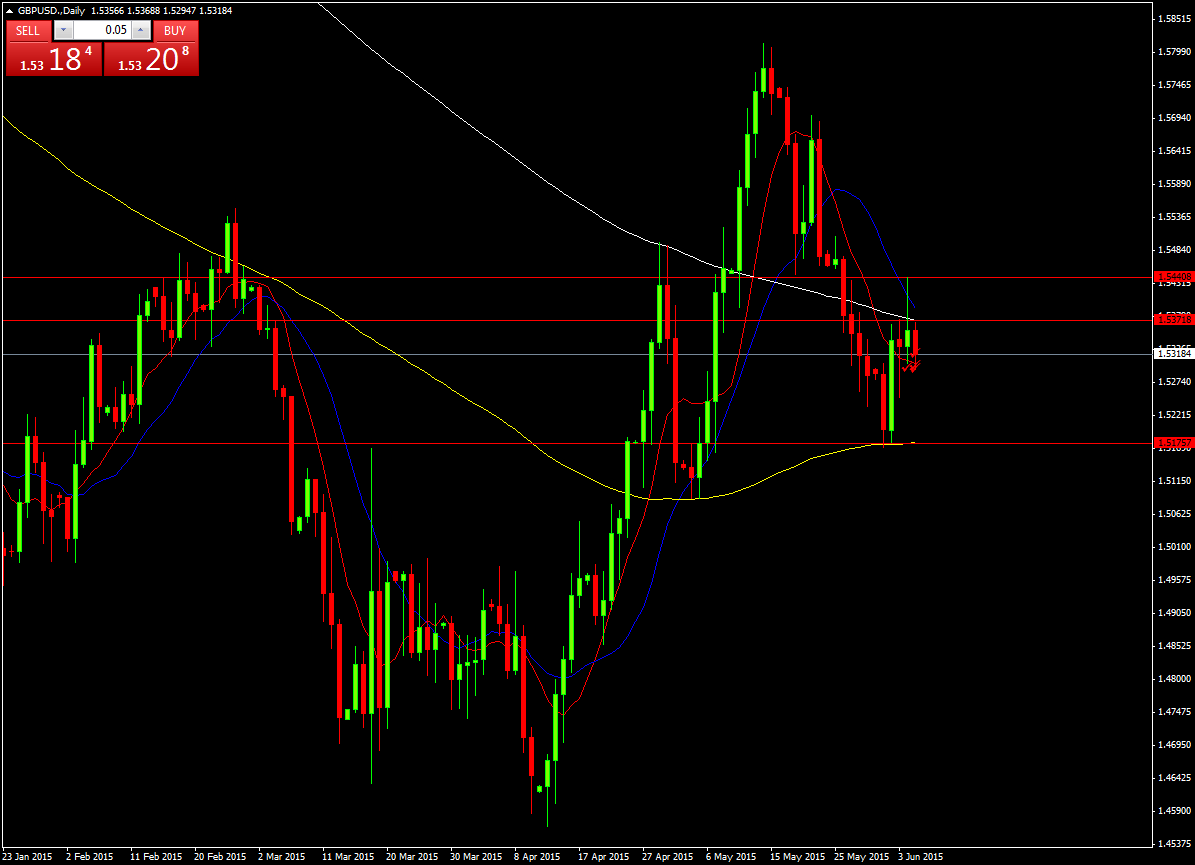

Technically, if the data comes out really strong, Eurusd might be at seen below 1.110, if it comes out negative, we might see Eurusd above 1.15. For GBPUSD, a strong NFP will drop cable to 1.50 and 1.55 if it’s below expectation. Gold is already trading low, a strong NFP will drop gold $1163 and above $1200 for a weak NFP.

Chart 1: Eurusd

Chart 2: GBPUSD