what lies ahead of USD

September 30, 2015The strength of USD over the past couple of trading weeks has been pretty impressive. Market seems to be pricing in ahead of FED rate hike, this explains why we could see a lot of position holding USD. Fundamentally, the economy has been really strong; the jobs market has shown a strong recovery and unemployment seems to have dropped to almost full employment. Last Quarter GDP figures also shows a strong economic growth which appears stronger than expected but inflation figures might be the major economic fundamentals which might be below the2% target.

As the year draws to a close, market might start to see some massive rally on USD in anticipation for a rate hike before the end of the year and also considering the fact that most China’s economy is in a slow mode at the moment. Investors and traders might switch to holding USD as the ultimate safe haven. This is why the market is currently feeling the heat of USD strength on commodities and commodity currencies. Commodities are major priced in USD; this has led to a massive sell off on most commodities: gold, copper etc.

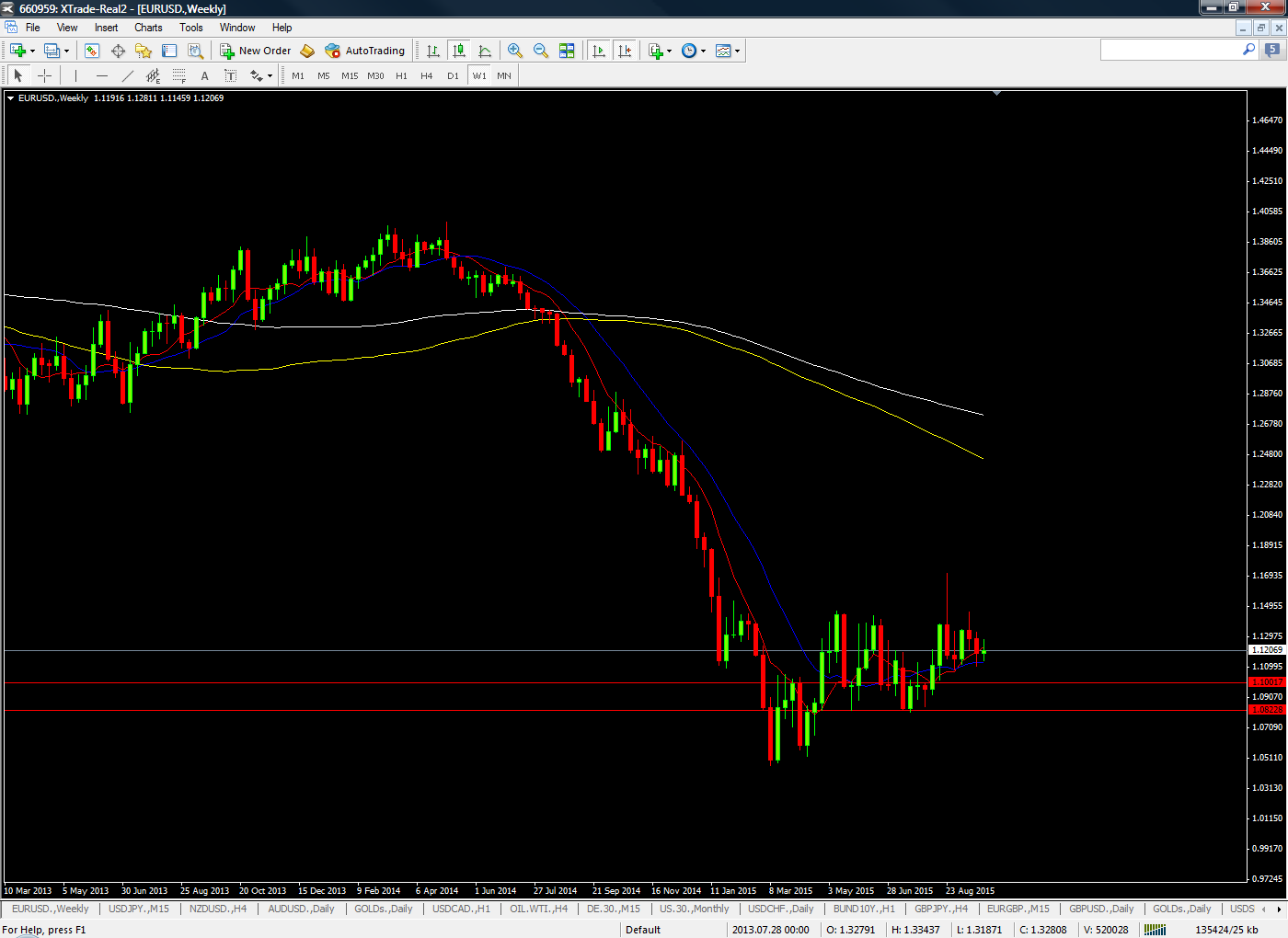

Technically, if the strength of USD continues, this could be aided by strong economic data expected before the end of the week (ADP and NFP etc.). This will continue to boost the strength of USD and more downside pressure on commodities. Commodities like gold could drop to as low as $1000 and next support level at $800. Eurusd could also drop to as low as 1.100 and next support at 1.08.

The chart below shows EURUSD price level and expected target.

Fig 1: EURUSD